Trading the London overlap is thrilling, however, asia session micro range tactics can bank calm pips while the Western world sleeps. Therefore, this expanded playbook shows you how to target three-to-five-pip stops in Tokyo, respect prop-firm limits, and avoid the boredom that sparks over-trading. You will leave with a formula, two data tables, a step-by-step flowchart, and a checklist you can paste into your journal—so your asia session micro range routine is mechanical, not emotional.

Stay session-smart. One concise email each week—session stats, rule updates, and fresh asia session micro range data—arrives when you join the free OrbitPips Newsletter.

1 – Why an

Asia Session Micro Range

Works

Asia liquidity is roughly one-third of London’s. Consequently, breakout algorithms stay dormant, spreads widen only slightly, and price often oscillates inside a ten-pip box. Because of that, asia session micro range fading fills more often than breakout orders, especially on pairs cleared through Tokyo (USDJPY, AUDJPY).

A second edge is timing: most Tier-1 news drops outside 00:00–05:00 UTC, giving you a cleaner tape. Refer to the official Tokyo Stock Exchange calendar to avoid holiday liquidity droughts.

(For the opposite—high-volatility overlap—read London–NY Overlap )

2 – Tokyo 2025 Micro-Range Statistics

|

Pair |

Avg box high–low (pips) |

25ᵗʰ pct |

75ᵗʰ pct |

|---|---|---|---|

|

EURUSD |

10 |

6 |

14 |

|

USDJPY |

9 |

5 |

13 |

|

AUDUSD |

11 |

7 |

15 |

|

BTCUSD perp |

$48 |

$32 |

$68 |

Stats from April–June 2025. Always re-check live ranges—holiday weeks can compress boxes by 30 %.

Need live spread info? OANDA publishes updated bid-ask averages here 👉 OANDA spread link.

3 – 7 Entry Rules for the

Asia Session Micro Range

-

Define the box – High/low of first 90 min (00:00–01:30 UTC).

-

Fade only extremes – limit orders ≤ 0.5 pip inside the edge.

-

Stop = 25 % of box (e.g., 2.5 pips on a 10-pip box).

-

Target 1 = mid-box for half position; Target 2 = opposite edge.

-

Time stop – flat by 05:00 UTC because London desks wake up.

-

News filter – skip if high-impact news < 30 min away.

-

Spread filter – if live spread ≥ 20 % of intended stop, cancel order.

Moreover, only fade once per side; over-scalping erodes R:R.

(Box-definition background? See Asia Range Reality.)

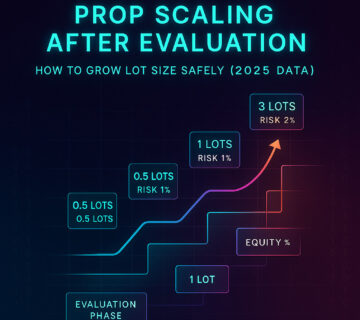

4 – Risk & Prop-Cap Matrix (FTMO 100 k example)

|

Box Size |

Max Risk % |

Lot ceiling |

Why it fits |

|---|---|---|---|

|

6 pips |

0.5 % |

4 lots EURUSD |

Tight spread offsets size. |

|

10 pips |

0.4 % |

3 lots USDJPY |

Stop = 2.5 pips. |

|

14 pips |

0.3 % |

2.5 lots AUDUSD |

London tails expand; risk down. |

Furthermore, crypto contracts need half the size above because weekend gaps double range volatility.

5 – Expanded Playbook Flow (Decision Tree)

IF box < 12 pips AND news gap > 30 min

→ place fade limits at ±0.5 pip inside box edge

→ stop = 25 % box

→ TP1 = mid-box; TP2 = opposite edge

ELSE

→ watch-only mode (no FOMO trades)6 – Real-World Scenario: EURUSD Tokyo Fade

Session date: 18 July 2025

Box: 00:00–01:30 UTC → High 1.1233 / Low 1.1223 (10 pips)

Plan: Sell 1 lot at 1.1232 (0.1 pip inside)

Stop: 1.1237 (5 pips, 50 % of box)

TP1: 1.1228 (+4 pips) partial close 60 %

TP2: 1.1224 (+8 pips) remainder

At 02:15 UTC price tags high, fills the short, and drops to mid-box in 6 minutes; TP1 triggers. However, spreads widen during Nikkei open; stop compresses to 4.4 pips effective, but still outside the wick. TP2 hits by 04:10 UTC. R:R realised = 1 : 1.2 blended. One trade, zero stress, equity curve +0.48 %.

7 – Psychology Corner: Quiet Session, Quiet Mind

-

Set a micro-goal. One to two trades maximum.

-

Use a kitchen timer for every pending order review—10-minute cool-offs reduce boredom clicks.

-

Journal micro-wins; the equity curve looks flat but they cover platform fees and build payout history.

-

Remember: prop auditors value drawdown control more than single-day home runs.

8 – Five-Point Checklist (Copy/Paste)

[ ] Tokyo box drawn (00:00–01:30 UTC)

[ ] Red news > 30 min away

[ ] Spread ≤ 20 % of planned stop

[ ] Stop = 25 % box

[ ] Flat all positions by 05:00 UTCFAQ – Quiet Tokyo & Micro-Ranges

Does spread ruin micro stops?

Most ECN brokers widen EURUSD by 0.3-0.5 pip at Tokyo open. Nevertheless, if your stop is 2.5 pips, spread ≤ 20 % of risk—acceptable per OANDA averages.

Can I apply this to crypto?

Yes, yet BTC’s box averages $48; therefore, halve risk or cut size by 50 %.

What about prop firm daily caps?

Micro-range risk is small; however, three simultaneous fades can still stack exposure. Log total risk before entry.

Disclaimer

Market conditions change. Always confirm live ranges before risking capital. This article is educational only and not financial advice.

No comment