The four-hour window when London winds down and Wall Street ramps up is the most liquid stretch on the planet. Consequently, london new york overlap volatility shapes every intraday tactic, from 5-pip scalps to 25-pip breakouts. Because of that, london new york overlap volatility percentiles—not averages—are your best compass. This long-form guide delivers:

-

Session micro-structure and timing.

-

Two extended percentile tables.

-

Liquidity sources behind london new york overlap volatility.

-

Eight key stats every overlap trader must know.

-

Position-sizing hacks tied to london new york overlap volatility ranges.

-

Firm-specific lot limits.

-

A 5-step execution playbook.

-

Printable checklist and FAQ.

Stay session-smart. One concise weekly email—session stats, prop tips, rule updates—arrives when you join the free OrbitPips Newsletter.

1 Why

London New York Overlap Volatility

Beats Averages

Averages hide nasty tails; therefore, london new york overlap volatility percentiles tell you how often price really moves 7, 17, or 28 pips. Knowing those bands lets you tighten stops and avoid dead pairs.

For the opposite dynamic—Frankfurt open stop-hunts—see Frankfurt Fakeout.

Overlap Timing & Liquidity Snapshot

-

Clock: 12:00–16:00 UTC (08:00–12:00 NYC).

-

Share of global FX volume: ≈ 35 %.

-

Spread compression during london new york overlap volatility: majors tighten 10–15 %.

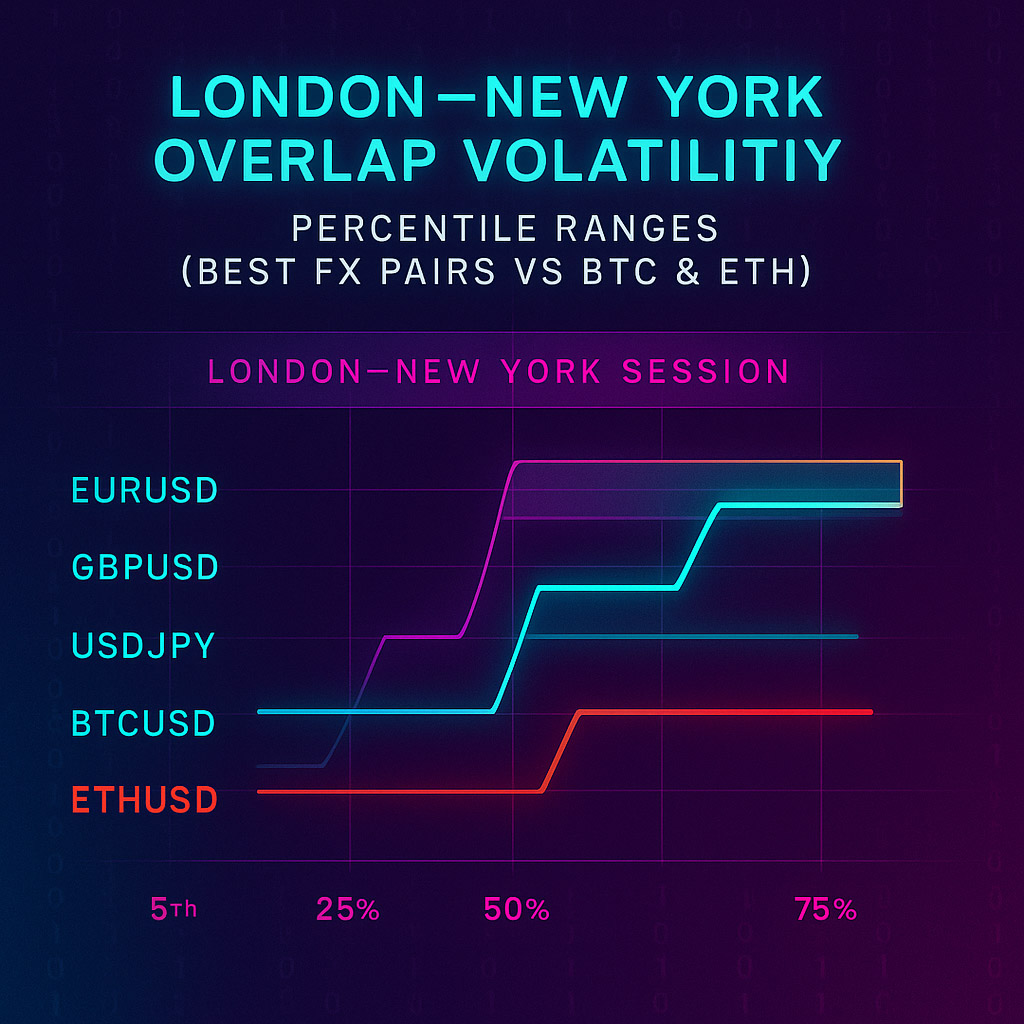

2 Major-FX Percentiles (Apr–Jun 2025)

|

Pair |

5ᵗʰ |

25ᵗʰ |

50ᵗʰ |

75ᵗʰ |

95ᵗʰ |

|---|---|---|---|---|---|

|

EURUSD |

4 p |

7 p |

11 p |

17 p |

28 p |

|

GBPUSD |

5 p |

9 p |

14 p |

22 p |

35 p |

|

USDJPY |

4 p |

8 p |

12 p |

18 p |

27 p |

|

XAUUSD |

30 c |

55 c |

90 c |

$1.40 |

$2.40 |

Percentiles refresh quarterly, keeping london new york overlap volatility stats current.

3 Crypto Percentiles

|

Asset |

5ᵗʰ |

25ᵗʰ |

50ᵗʰ |

75ᵗʰ |

95ᵗʰ |

|---|---|---|---|---|---|

|

BTCUSD |

$32 |

$54 |

$78 |

$132 |

$260 |

|

ETHUSD |

$1.8 |

$3.2 |

$5.0 |

$8.6 |

$15.4 |

4 Eight Key Stats & Position-Sizing Hacks

-

GBPUSD 75ᵗʰ = 22 p.

-

EURUSD tail tops 28 p.

-

Gold median 90 c.

-

USDJPY 95ᵗʰ 27 p.

-

BTC median outruns majors.

-

ETH spike 15 $.

-

Spread compression boosts R:R.

-

Tier-1 US data hits overlap 78 % of the time.

Tie these to risk in 1 % Risk Myth.

5 Best Pair by Trading Style

|

Style |

Pair |

Why it clicks in london new york overlap volatility |

|---|---|---|

|

Scalp 3–5 p |

EURUSD, USDJPY |

Tight spreads, shallow tails. |

|

Momentum 10–20 p |

GBPUSD |

Higher medians without whipsaws. |

|

News burst |

XAUUSD, BTCUSD |

Big 75ᵗʰ percentiles give runway. |

|

Low-stress swing |

EURUSD |

Stable range, shorter tails. |

6 News Calendar & Risk Filters

Overlap sees CPI, NFP, FOMC minutes. If the 15-min range prints above the 75ᵗʰ percentile, reduce size 50 %. That keeps your london new york overlap volatility exposure inside firm caps.

7 Prop-Firm Lot Limits

The Babypips overlap primer notes spread tightening but warns about velocity jumps.

-

FundedNext halves BTC lots 12:00–14:00 UTC.

-

FTMO enforces 60-s hold on XAUUSD if opened < 1 min post-news.

-

E8 lifts margin 25 % on gold every NFP Friday.

Always cross-check these before exploiting london new york overlap volatility in gold or crypto.

8 Execution Playbook (5 Steps)

-

Block news times five minutes either side.

-

Set stop floor at 25ᵗʰ percentile of chosen pair.

-

If live 15-min range > 75ᵗʰ, cut position size in half.

-

Scale out in thirds; median range often fills within 60 min.

-

Journal pair–range–size–outcome for equity-curve smoothing.

9 Printable Checklist

[ ] Check overlap calendar & news

[ ] Confirm spread ≤ usual

[ ] Stop at 25th percentile

[ ] Size down if range > 75th

[ ] Log trade outcomeFAQ –

London New York Overlap Volatility

Does crypto always beat FX?

Often yes, but BTC stalls if S&P futures go flat. Consequently, check equity tone first.

Best timeframe for percentiles?

We use M15; run M5 for micro-scalps.

Are gold spreads tight?

ECNs widen XAUUSD ≈ 1 pip during red-news; adjust stops.

Disclaimer

Historical stats differ from live tape. Always confirm real-time london new york overlap volatility before risking capital. Educational content—no financial advice.

[…] the opposite—high-volatility overlap—read London–NY Overlap Volatility […]

[…] London–NY overlap already delivers velocity; pre fomc spread widening adds cost on top of speed. A 15-pip move may still print, but entry spread doubles, crushing R:R. Full overlap stats live in London New York Overlap Volatility. […]