Free Swap-Neutral Momentum Indicator for TradingView

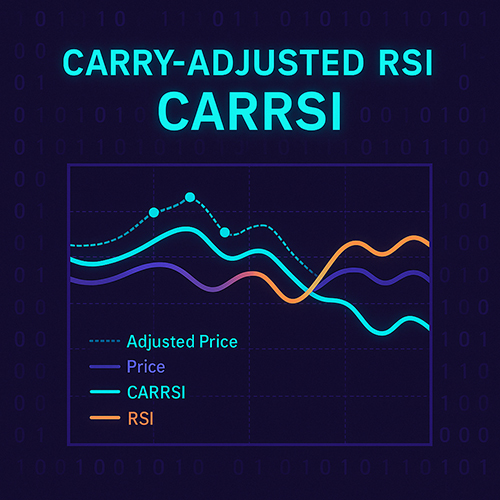

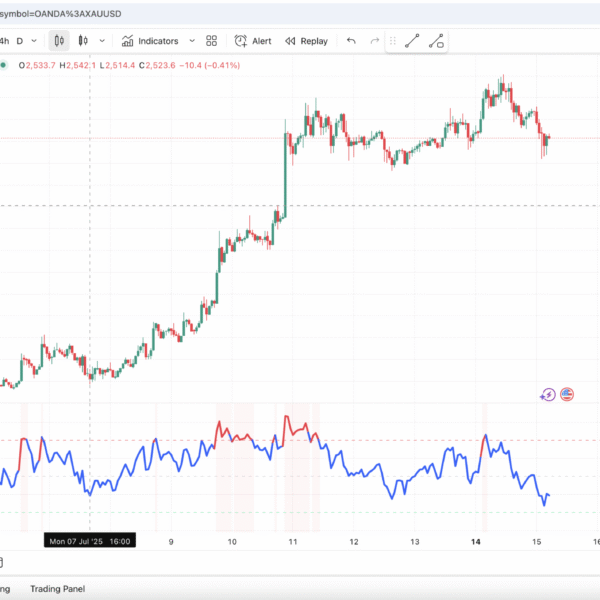

Carry-Adjusted RSI (CARRSI) is the first RSI that shifts price by the interest-rate differential (FX) or perpetual-funding rate (crypto) before the RSI calculation.

The carry-driven “price drift” disappears, so you see pure momentum—perfect for high-swap pairs such as AUDJPY or perpetuals like BTCUSDTPERP.

Why CARRSI Beats a Classic RSI

| Feature | Practical Edge |

|---|---|

| Carry Drift Removed | Momentum signals are no longer skewed by overnight swap or funding payments. |

| Three Data-Source Modes | 1) Forex Live — official central-bank rates2) Crypto Live — real-time exchange funding3) Manual — enter your own rates |

| Instant Analytics Panel | Live read-outs of annual carry, CARRSI value, delta vs classic RSI and cumulative carry, colour-coded for clarity. |

| Adaptive Alerts | Built-in crossings of 70/30 and 50 levels. |

| Monochrome Accessibility | Optional colour-blind friendly palette. |

| Time-Frame Guard | Refuses to run below 5-minute charts to avoid noise and numeric overflow. |

How It Works (Under the Hood)

- Fetch / Input Carry Rate

• Forex: Base-currency rate − Quote-currency rate (e.g., AUD − JPY).

• Crypto: Annualised funding rate. - Convert to Per-Bar Rate

Annual % → per-bar fraction, based on your chart’s interval. - Shift the Price Series

Adjusted Price = Close × exp(−Cumulative Carry). - Compute RSI on the Adjusted Price

Classic 14-period RSI logic; output = CARRSI. - Generate Alerts & Table

Visual and alert-based signals exactly like a normal RSI—now carry-neutral.

Quick Start Guide

- Open the author’s TradingView profile and click “Add to favourites” on Carry-Adjusted RSI (CARRSI).

- Apply it to a chart—try AUDJPY, EURTRY, BTCUSDTPERP, etc.

- Choose Data Source Mode in settings: Forex Live, Crypto Live or Manual.

- Keep Analytics Table enabled to watch the live difference vs classic RSI.

- Optionally flip the Monochrome Mode switch for low-contrast themes.

Best Pairs & Time-Frames

- Forex: AUDJPY, NZDJPY, EURTRY — 1 h or 4 h

- Crypto: BTCUSDTPERP, ETHUSDTPERP — 1 h

- Swing traders: Daily charts + Manual mode for custom precision

Frequently Asked Questions

Is it really free?

Yes. Request access; we’ll approve within 24 h.

Why isn’t the source open?

To protect proprietary logic for live rate handling and to stop copy-paste reposts.

What advantage over a normal RSI?

Normal RSI measures price moves plus swap/funding drift; CARRSI strips that out.

Can I enter my own interest/funding numbers?

Absolutely—select Manual mode and type any annual rates you like.

Why can’t I run it on a 1-minute chart?

Below 5 m the carry per bar is microscopic and numerical precision suffers; we block those time-frames for your safety.

1 review for Carry-Adjusted RSI (CARRSI)

There are no reviews yet.