Free Risk-Management Indicator

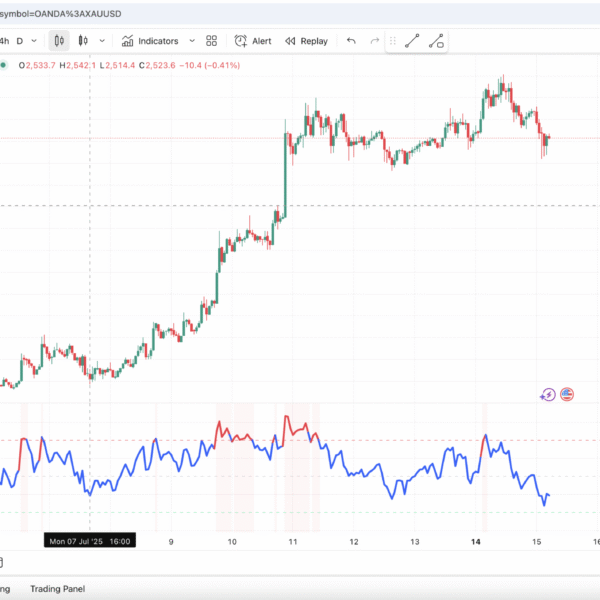

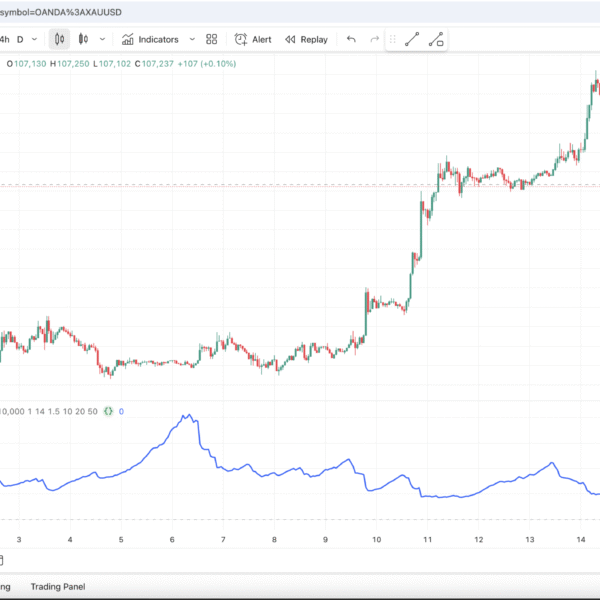

ATR Adaptive Position Sizer indicator (APS for short) is the fast, error-proof way to calculate position size in real time from your account equity, fixed risk %, current ATR and pip value. Consequently, you never reach for a calculator again—APS prints the exact number of lots / coins, shows the leverage you will use and highlights any risk overruns the very next bar.

Why this Indicator is Matters

| Feature | Practical Benefit |

|---|---|

| ATR-based sizing | Position size adapts to actual market volatility, so stops are neither too tight nor too loose. |

| Fixed dollar risk | Enter Equity and Risk % once; the script keeps your risk capital constant on every trade. |

| Leverage & risk alerts | Cells turn orange or red and pop-up alerts fire whenever leverage or position risk breaches your limits. |

| Pro analytics panel | A modern colour-coded table displays ATR, stop distance, position value, leverage and more in one place. |

| Works on forex & crypto | APS auto-detects Crypto symbols and switches the default pip / tick value to 1.0. |

| 100 % free | Pine v6 code |

How the ATR Adaptive Position Sizer Works—Step by Step

- First, ATR with your chosen length (default 14) is calculated.

- Next, Stop-Loss distance = ATR × Multiplier (e.g. 1.5).

- After that, Risk $ = Equity × (Risk % ÷ 100).

- Position size = Risk $ ÷ (Stop distance × Pip Value) and is displayed as “lots” or “coins.”

- Meanwhile, leverage used and total position-to-equity % update on every bar; if either metric exceeds its threshold, the table cell turns red and an alert is sent.

Quick Start with the ATR Adaptive Position Sizer Indicator

- In TradingView, open Indicators → search “ATR Adaptive Position Sizer” → add to chart.

- Choose a 1 H or 4 H timeframe for smoother ATR readings.

- Inside the settings, enter:

• Account Equity ($)

• Risk % per Trade

• Max Allowed Leverage - Instantly, the analytics panel appears in the chart corner and shows your exact position size.

- Finally, enable alerts so TradingView notifies you when leverage or risk approaches the limit.

Trading Ideas Powered by the ATR Adaptive Position Sizer

- Crypto scalping – Because ATR captures intraday volatility, position size automatically shrinks during wild moves.

- Forex swing trading – Fixed dollar risk keeps your equity curve smooth even across high-impact news events.

- Algorithmic portfolios – Pipe APS outputs into Pine strategies or external bots to enforce uniform risk across dozens of pairs.

FAQ

Is the indicator really free?

Yes. APS is 100 % free and open-source on TradingView.

Can I change colours or thresholds?

Absolutely. Open the Pine script and tweak any palette value or input default.

Why use ATR instead of a fixed pip stop?

Because ATR tracks live volatility, ensuring your stop-loss and position size match current market conditions.

How is pip value handled for crypto pairs?

The script automatically sets Pip Value to 1 for Crypto symbols, but you can override it manually.

1 review for ATR Adaptive Position Sizer (APS)

There are no reviews yet.