Prop Scaling After Evaluation – How to Grow Lot Size Safely (2025 Data)

Passing a prop challenge feels fantastic; however, prop scaling after evaluation is where most traders stumble. Therefore, this guide delivers a 2025-ready ladder that lets you raise lot size while staying inside every rule. In addition, you’ll see links to earlier risk tools so each idea plugs into one neat system.

Stay compliant. Subscribe to the free OrbitPips Session Newsletter and receive one concise email each week with prop tips, risk hacks, and rule updates.

Why

Prop Scaling After Evaluation

Is So Dangerous

|

Risk |

What Happens |

Why It’s Worse After Funding |

|---|---|---|

|

Over-confidence |

Traders double size overnight. |

Real capital and payout reviews are now at stake. |

|

Hidden lot caps |

Aggregate limits get exceeded. |

Consequently, the platform may auto-liquidate positions. |

|

Consistency flags |

One giant win skews monthly PnL. |

Therefore, the payout desk can slice or withhold profit. |

|

Daily-drawdown clash |

Larger lots boost volatility. |

Ultimately, a single loss can close the account. |

Need a buffer plan? Read Daily Drawdown Buffer

July 2025 Scaling-Rule Snapshot

|

Prop firm |

Scaling trigger |

Lot / balance ceiling |

Extra consistency rules |

|---|---|---|---|

|

FTMO |

+10 % equity → +25 % balance & max-loss |

≤ 100 lots majors |

Largest lot ≤ 2 × 30-trade avg |

|

MyForexFunds |

+5 % per payout cycle |

50 lots per ticket |

Triple-lot jump pauses payouts |

|

E8 Markets |

+25 % equity → tier bump |

80 lots combined |

Manual curve review at payout |

|

FundedNext |

Weekly +5 % equity |

Contract table per account |

± 200 % weekly lot deviation |

|

The5ers |

+10 % profit tiers |

Notional ≤ 1 % balance |

SL/TP ≥ 15 pips during red-news |

Because firms revise PDFs often, always download the newest rulebook before trading.

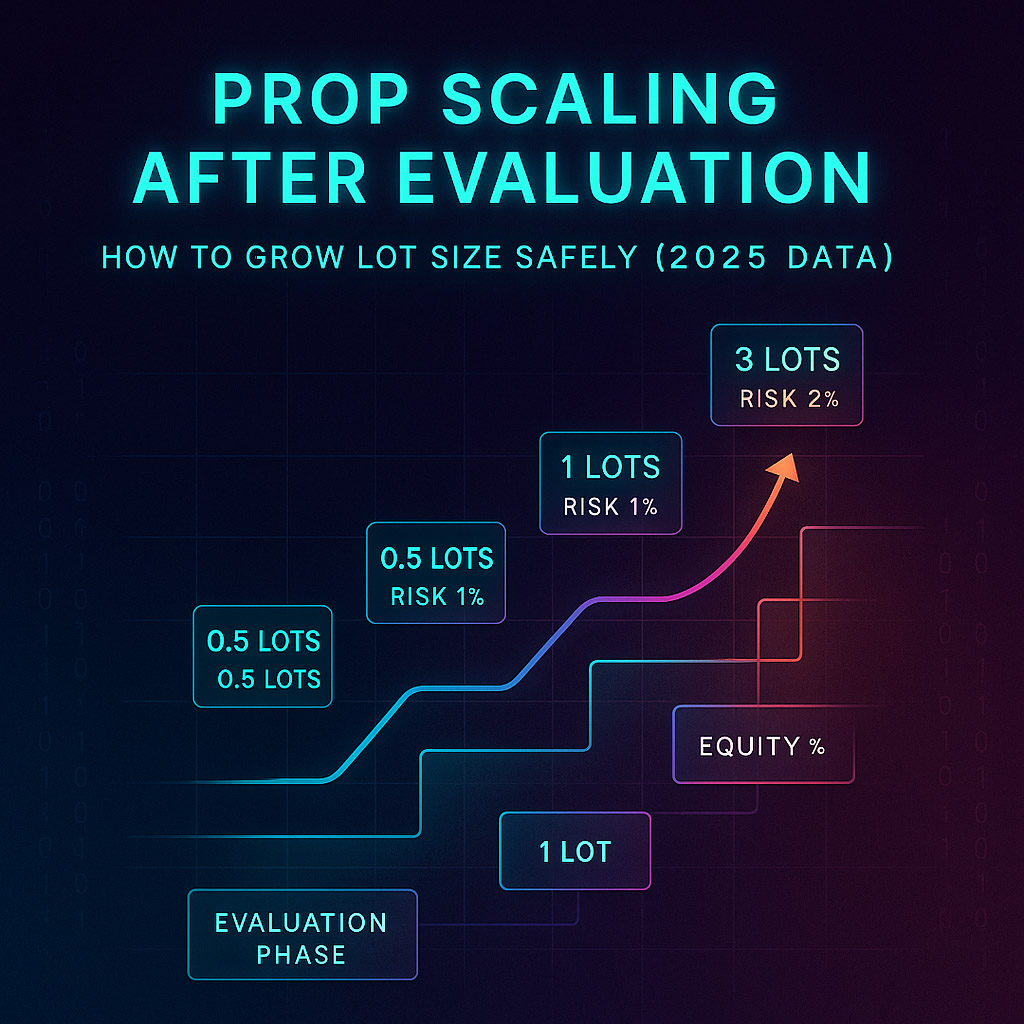

Three-Tier Ladder for

Prop Scaling After Evaluation

Tier 1 – Preservation

-

Risk 0.25 – 0.5 %

-

First 20 trading days

-

Goal – craft a spotless record

Tier 2 – Controlled Growth

-

Trigger = equity +5 – 7 % and ≥ 15 trades

-

Risk 0.5 – 0.75 %; lots +10 % / week

-

Largest lot ≤ 2 × 30-trade average

Tier 3 – Performance

-

Trigger = equity +10 – 15 %, zero violations

-

Risk up to 1 % (firm permitting)

-

Add 0.1 lot for every extra +1 % equity

Moreover, build a 2 % daily-drawdown buffer before you graduate to the next tier.

Practical Walk-Through

Imagine a $100 000 FTMO funded account. Initially, Tier 1 risk equals 0.5 % (≈ $500). Afterward, a 7 % gain lifts balance to $107 000; consequently, Tier 2 unlocks. Risk rises to 0.6 % and lots climb 10 %. The 30-trade average lot is 1.6, so the new ceiling becomes 3.2 lots (double the average) and still meets every cap. When equity later touches +15 % while the buffer stays above 2 %, Tier 3 activates. Finally, you can edge toward full 1 % risk and remain compliant.

Essential Risk Guards

-

Consistency ceiling: never exceed twice your 30-trade average lot.

-

Buffer rule: size up only when today’s buffer ≥ 2 %.

-

Additionally, freeze lot increases during news-blackout windows (see News-Trading Restrictions 2025 → [internal-link-news-ban]).

-

Furthermore, if the 20-day ATR jumps above 150 %, cut risk by half.

-

Besides that, re-confirm ticket caps after each scaling tier.

Collectively, these five filters reinforce your ladder and reduce surprise breaches.

Quick Journal Template

Date ______ Balance ______

Tier 1 / 2 / 3 Daily buffer ______ %

30-trade avg lot ______ Ceiling (×2) ______

Trade | Lot | Risk % | Result % | Rules OK? Y/N

------|-----|--------|----------|--------------FAQ — Rapid Answers on

Prop Scaling After Evaluation

Why is prop scaling after evaluation slower than personal accounts?

Prop rules—lot caps, consistency ceilings, and daily-loss limits—punish sudden jumps; therefore, steady scaling protects payouts.

What if equity dips below my tier trigger?

In that event, drop back one tier, shrink lot size, and rebuild the buffer.

Will firms relax limits after several payouts?

Yes. Some grant custom risk or higher caps, provided your record stays spotless.

Are partial closes allowed?

Usually they are, and they smooth lot averages; nonetheless, confirm inside your firm’s handbook.

Disclaimer

Firm policies can change without notice. Consequently, you should read the current rulebook before trading. This article is educational only and not financial advice.

[…] Re-link lot sizing to equity bands in Prop Scaling After Evaluation. […]