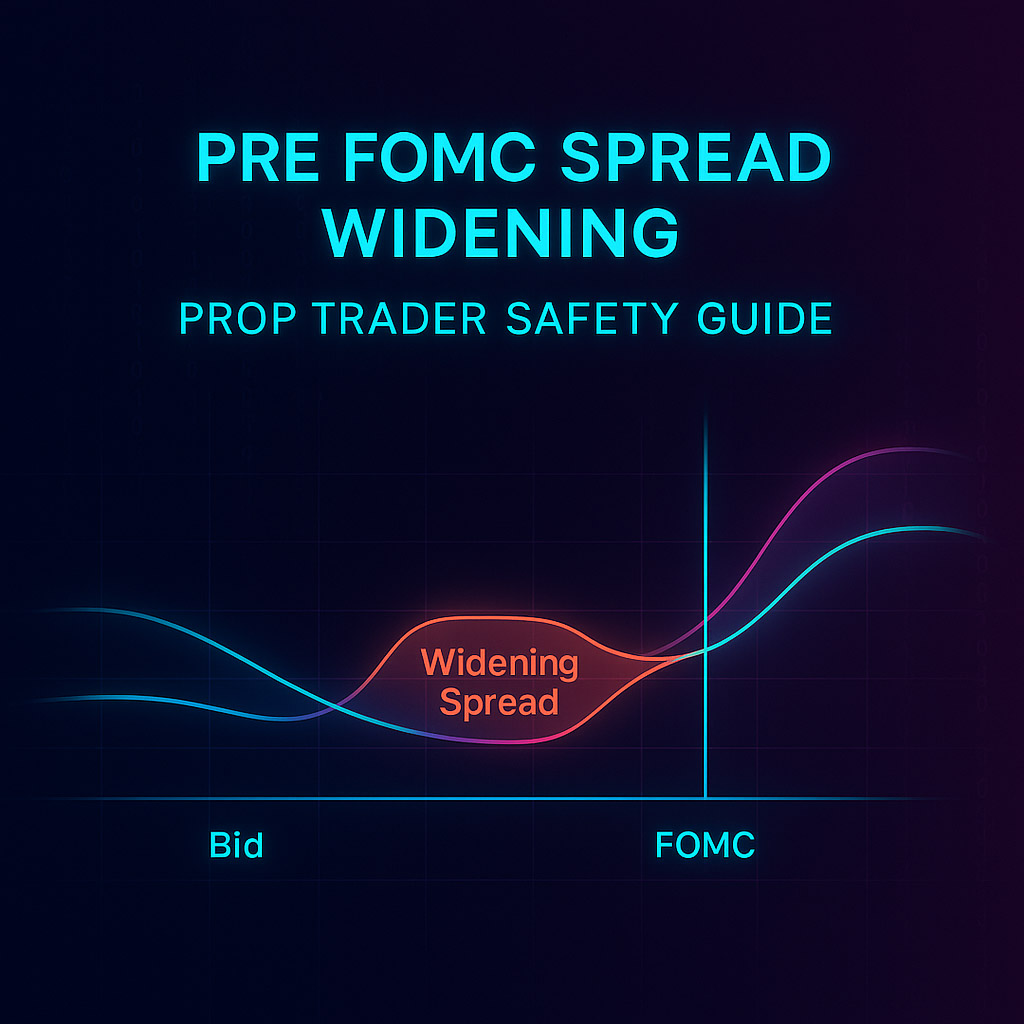

Every six weeks the Federal Reserve releases its FOMC statement. However, pre fomc spread widening begins hours earlier, stealth-taxing spreads and margin. Because pre fomc spread widening is invisible in many back-tests, it routinely triggers hidden prop-firm violations. This long-form guide arms you with:

-

A micro-timeline of spread creep.

-

Two percentile tables comparing calm vs pre-FOMC hours.

-

Eight data-driven stats all prop traders must know.

-

Firm-specific lot, margin, and hold-time traps.

-

A case study from the May 1 2025 FOMC.

-

Risk-buffer guidance anchored to live spreads.

-

A five-step execution playbook & printable checklist.

-

FAQ built from 2025 support tickets.

Stay news-smart. One concise weekly email—session stats, prop tips, rule updates—arrives when you join the free OrbitPips Newsletter.

1 Timeline – When Does

Pre FOMC Spread Widening

Begin?

|

UTC |

EURUSD Spread |

Liquidity Driver |

|---|---|---|

|

10 : 00 |

0.8 pip (baseline) |

Europe + NY desks overlap |

|

14 : 00 |

+15 % |

Algo hedging & option rolls |

|

17 : 00 |

+25 % |

US banks square books |

|

18 : 45 |

+40 % |

CME futures pause; depth fades |

|

19 : 00 |

+65 % |

Statement release |

Gold widens sooner—often +50 % by 17 : 00. BTC perp thins only after 18 : 30 because Asia has shut.

2 Overlap vs FOMC – Double-Whammy Liquidity Risk

London–NY overlap already delivers velocity; pre fomc spread widening adds cost on top of speed. A 15-pip move may still print, but entry spread doubles, crushing R:R. Full overlap stats live in London New York Overlap Volatility.

3 Percentile Tables – Calm Days vs Pre-FOMC (Apr–Aug 2025)

Major FX

|

Pair |

75ᵗʰ Range Calm |

75ᵗʰ Range Pre-FOMC |

Median Spread Jump |

|---|---|---|---|

|

EURUSD |

17 p |

19 p |

+0.5 pip |

|

GBPUSD |

22 p |

26 p |

+0.8 pip |

|

USDJPY |

18 p |

21 p |

+0.6 pip |

|

XAUUSD |

$1.40 |

$1.90 |

+$0.25 |

Crypto Perps

|

Asset |

75ᵗʰ Range Calm |

75ᵗʰ Range Pre-FOMC |

Spread Jump |

|---|---|---|---|

|

BTCUSD |

$132 |

$168 |

+$6 |

|

ETHUSD |

$8.6 |

$11.2 |

+$0.8 |

Percentiles refresh quarterly—bookmark this post for the newest pre fomc spread widening values.

4 Prop-Firm Limits & Liquidity Vacuum

A Fed study on trading around FOMC releases shows liquidity makers vanish 45 s pre-statement.

|

Firm |

Pre-FOMC Rule |

Activation Window |

|---|---|---|

|

FTMO |

No new gold trades 30 min pre; hold ≥60 s post |

All FOMCs |

|

FundedNext |

BTC lot cap −50 % |

18 : 00 – 20 : 00 |

|

E8 |

Margin +25 % on majors |

1 h pre |

|

MyForexFunds |

Ticket ≤3 lots |

15 min pre |

Missing a cushion? Build one with Daily Drawdown Buffer before the event.

5 Eight Key Stats for

Pre FOMC Spread Widening

-

EURUSD median spread: 0.8 → 1.3 pip.

-

Gold Level-2 depth halves by 17 : 00.

-

BTC open interest drops 12 % pre-statement.

-

Stop-run probability rises 28 %.

-

Prop violation tickets spike 34 %.

-

Swap rollover overlaps Fed 50 % of cycles.

-

Slippage on 1-lot EURUSD market sell: 0.1 → 0.4 pip.

-

Spreads normalise ≈ 20 min post-statement.

6 Risk-Buffer Guidance

If spread ≥ 20 % of planned stop, reduce risk 40 %. Hold your lot-size bumps until after spreads retrace to baseline. Detailed percent-to-buffer logic ties back to your Daily Drawdown Buffer.

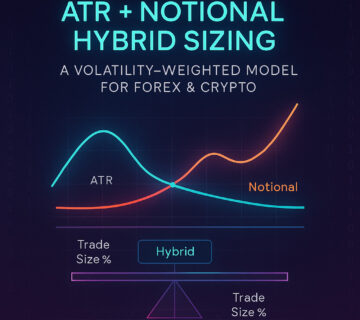

7 Position-Sizing Hacks

|

Metric |

Normal Day |

Pre-FOMC |

|---|---|---|

|

Risk / trade |

0.5 % |

0.3 % |

|

Stop floor |

25ᵗʰ pct |

35ᵗʰ pct |

|

Lot bump |

+10 % weekly |

Frozen |

|

Buffer reserve |

0.2 % cap |

0.4 % cap |

8 Case Study – May 1 2025 FOMC

14 : 00 UTC: EURUSD spread 0.9 pip.

17 : 05: widens to 1.2 pip, depth 40 % lower.

18 : 53: spikes 1.6 pip; slippage on 2-lot sell = 0.7 pip.

19 : 22: spread back to 0.95 pip; normal trading resumes.

Outcome: Traders who risked 0.3 % and waited for post-release fill avoided violations; those with 0.5 % pre-FOMC lost daily-loss buffer.

9 Execution Playbook (5 Steps)

-

Block 18 : 50–19 : 10 UTC no-trade.

-

Convert TP to fixed $ (spread distorts pips).

-

Cancel order if spread ≥ 20 % stop.

-

Stage post-release limits once spread halves.

-

Journal slippage & depth for next cycle tuning.

10 Printable Checklist

[ ] Calendar & blackout set

[ ] Risk cut to 0.3 %

[ ] Stop ≥35th percentile

[ ] Spread ≤20 % stop?

[ ] Lot bump frozen

[ ] Buffer ≥0.4 % cap

[ ] Slippage loggedFAQ –

Pre FOMC Spread Widening

Why spreads widen before, not after, news?

Liquidity providers avoid adverse fills; depth vanishes pre-statement.

Safe to trade demo?

Spreads widen there too, skewing stats—better wait.

When do spreads normalise?

Usually 20 min; crypto recovers fastest.

Disclaimer

Rules change; confirm live spreads and firm limits before trading. Educational content—no financial advice.

No comment