Trading rules sound simple: “Don’t exceed five percent per day.”

However, max daily loss math turns that headline rule into a concrete trade count. Therefore, this guide delivers a formula, two fully-worked tables, an expanded real-world scenario, and a five-step playbook so you never trigger a max daily loss math violation again.

Stay risk-smart. Get the free OrbitPips Newsletter—one concise email every week with risk calculators, prop-firm updates, and fresh max daily loss math tables.

1 – Why Max Daily Loss Math Matters

Prop desks shut an account as soon as intraday equity crosses the cap. Consequently, “risk one percent per trade” can still stack exposure far past the five-percent line. Because of that, max daily loss math is your first defence.

Need an equity cushion first? Read Daily Drawdown Buffer.

2 – The Core Formula

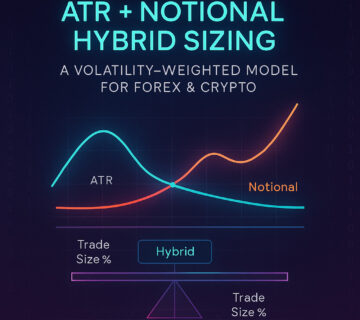

Trades allowed =

(Daily-cap % ÷ Risk % per trade)

× (Stop distance ÷ ATR factor)

Example. Cap = 5 %, risk = 0 .5 %, stop = 0 .5 × ATR

(5 ÷ 0.5) × (0.5 ÷ 0.5) = 10 trades.

If the stop expands to 1 × ATR, the denominator doubles; you may now open only 5 trades.

More context on ATR sizing is in the BabyPips position-sizing primer

3 – Quick-Reference Table (5 % Cap)

| Risk % per trade | Stop size (ATR fraction) | Max concurrent trades | Comment |

|---|---|---|---|

| 1.0 % | 1.0 × | 5 | No room for slippage. |

| 0.75 % | 0.8 × | 6 | Leaves ≈ 0.2 % buffer. |

| 0.5 % | 0.5 × | 10 | Most evaluation accounts. |

| 0.25 % | 0.5 × | 20 | Grid & scale-ins. |

For a 3 % daily cap multiply the “Max trades” column by 0 .6.

3.1 – 3 % Cap Table (bonus)

| Risk % | Stop (½ ATR) | Trades |

|---|---|---|

| 1 % | 5 pips | 3 |

| 0.75 % | 4 pips | 4 |

| 0.5 % | 3 pips | 6 |

| 0.25 % | 3 pips | 12 |

4 – Using the Table in Real Time

- Confirm your cap. FTMO = 5 %, E8 top tier = 8 %, some programs = 3 %.

- Choose risk %. Many pass challenges at 0 .5 %.

- Measure 20-period ATR on the entry timeframe.

- Make sure stop ≤ targeted ATR fraction. If wider, lower the risk.

- Count trades and merge correlated themes (EURUSD, GBPUSD, AUDUSD all USD-weakness = one bucket).

5 – Lot-Cap Reality Check (mid-2025)

| Prop Firm | Daily Cap | Lot Ceiling | In-practice takeaway |

|---|---|---|---|

| FTMO | 5 % | 100 lots majors | Even 0.5 % risk + 3-pip stop can exceed cap—see the rule FTMOlinkFTMO link. |

| FundedNext | 6 % | Dynamic contract table | Crypto lots halve in London–NY overlap. |

| The5ers | 4 % | Notional ≤ 1 % balance | Risk must drop so math & notional align. |

Need lot growth tips? Read Prop Scaling After Evaluation.

Another institutional-style overview is Investopedia’s article on position sizing.

6 – Expanded Example Scenario

Account: $100 000 FTMO funded

Daily cap: $5 000 (5 %)

Risk per trade: $500 (0 .5 %)

Stop size: 5 pips (0 .5 × ATR)

Plan: 10 Tokyo-session micro-range fades

A surprise CPI leak widens spreads; stops effectively balloon to 0 .9 × ATR on EURUSD and GBPUSD. Therefore, the new trade allowance computes to

(5 ÷ 0.5) × (0.5 ÷ 0.9) ≈ 5.5 trades.

You already have six positions. The sixth trade pushes theoretical exposure above cap before any slippage. Five minutes later spreads widen another 0.3 pip; the account prints –5 .1 % intraday loss and trips the daily circuit breaker.

Lesson: recalculate after every volatility event and keep at least 0 .2 % cap unused.

7 – Five-Point Playbook

- Open spreadsheet pre-filled with both tables.

- Enter current balance – risk dollar values auto-populate.

- Tag correlations → collapse into single risk line.

- If exposure ≥ 80 % cap, freeze new trades.

- Log results so your equity curve looks smooth for payout review.

8 – Quick Checklist

[ ] Daily cap % _______

[ ] Risk % per trade _______

[ ] 20-ATR _______

[ ] Stop ≤ fraction? Y / N

[ ] Trades open ______ ≤ table

[ ] Correlation merged

FAQ – Max Daily Loss Math

Does slippage break the math?

Yes—reserve ≥ 0 .2 % of the cap. Consequently, trade fewer lots than the table’s max.

Is averaging down safe if I stay under the cap?

Only if each add-on respects the remaining buffer. In practice, aim for half the cap.

How do red-flag news events affect math?

Spreads widen; therefore, ATR fractions rise. Re-measure stops before big releases.

Disclaimer

Prop-firm caps change without notice. Always verify current limits before trading. This article is educational only and not financial advice.

No comment